The construction sector continues to show signs of recovery, with supply and demand imbalances driving new theses. While actual construction starts continue to show a significant year-over-year decrease, starts themselves are up month-over-month, and permits are at an all-time high – signifying the industry’s desire to fill the supply gap created by the pandemic as the year continues and 2022 comes into sight.

Below are key takeaways from the following reports:

Multifamily Construction Plunges – YieldPro – Link

Multifamily Housing Permits Surge in January – YieldPro – Link

Download the PDF version of this report here:

Multifamily Construction Plunges

YieldPro

- Dodge Data & Analytics (DD&A) says only three of the top 20 metropolitan areas posted gains for the year as the COVID pandemic weighed down construction starts

- DD&A indicates the value of commercial and multifamily construction starts in the top 20 metropolitan areas of the U.S. declined 23 percent in 2020, falling to $111.1 billion

- The New York metropolitan area continued to be the largest market for starts at $23.5 billion despite suffering a stark 25 percent decline from 2019. Houston suffered the biggest dip, sliding a staggering 47 percent to $4.5 billion. Phoenix, Ariz., posted a 32 percent gain, climbing to $5.3 billion.

- Only Denver, Colo. (+17 percent to $3.3 billion) and Kansas City, Mo. (+20 percent to $2.5 billion) posted increases for the year

Multifamily Housing Permits Surge in January

YieldPro

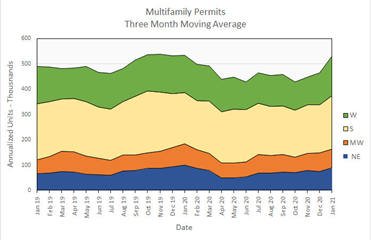

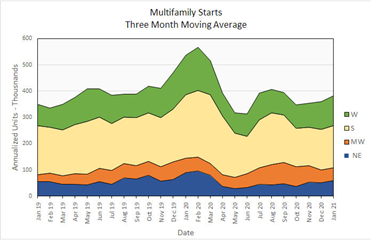

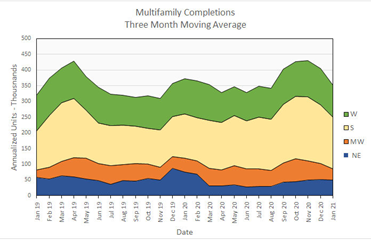

- The Census Bureau released its monthly new residential construction report for January 2021. It shows a rise in permits and starts of multifamily housing units but a drop in unit completions.

- Multifamily Housing Construction Permits Rise Sharply:

- Multifamily Housing Construction Starts Rise:

- Multifamily Housing Completions Down:

- Multifamily Housing Construction Permits Rise Sharply: