Low-density markets continue to garner developer attention, especially given the potential fall-out from COVID-19. While new starts continue the downward trend and completions remain soft, new permits ticked upwards in May. The anticipated construction cost boon has largely reversed, but there may be hope as lower rent growth causes costs to naturally adjust.

Below are key takeaways from the following reports:

Multifamily Construction Gaining Market Share in Low Density Markets – Multifamily Executive – Link

Multifamily Housing Construction Up in May – YieldPro – Link

Construction Costs Expected to Ease for Apartment Developers – National Real Estate Investor – Link

Download the PDF version of this report here:

Multifamily Construction Gaining Market Share in Low Density Markets

Multifamily Executive

- NAHB’s Home Building Geography Index says residential construction is expanding faster in regions of lower population density

- Over the past year, apartment construction growth in less dense markets has outpaced expansion in larger metropolitan areas, leading to changes in apartment construction market share

- This trend is likely to continue as housing leads the U.S. economic recovery from the coronavirus-induced slump, albeit with changed housing demand reflecting a preference for lower-density markets

Multifamily Housing Construction Up in May

YieldPro

- The Census Bureau released its monthly new residential construction report for May 2020. It shows the start of a rebound in multifamily housing construction

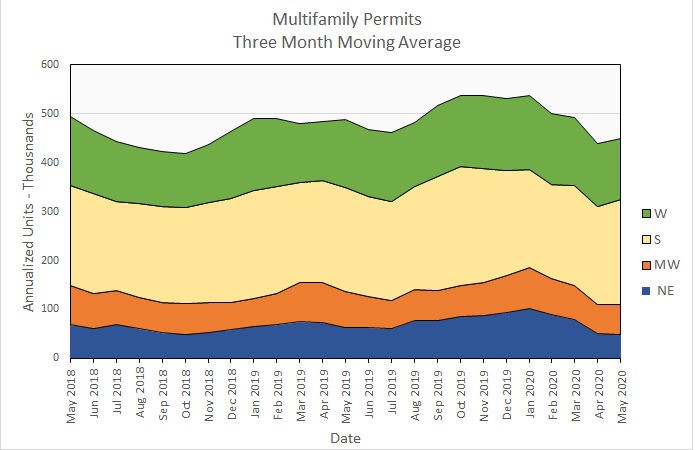

- Permits Tick Upwards:

-

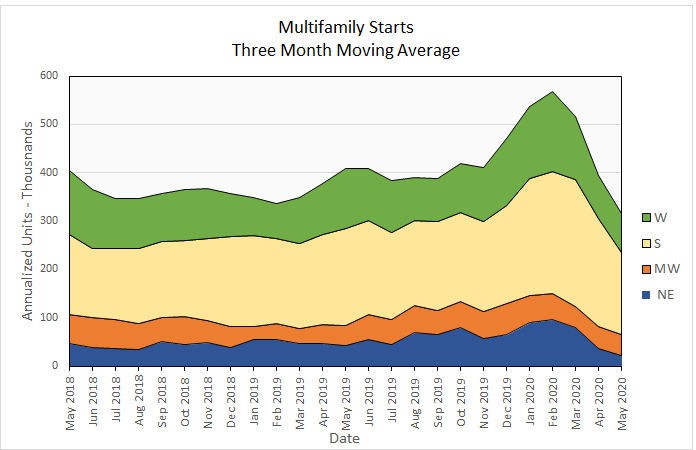

- Multifamily Starts Continue Downward Trend:

-

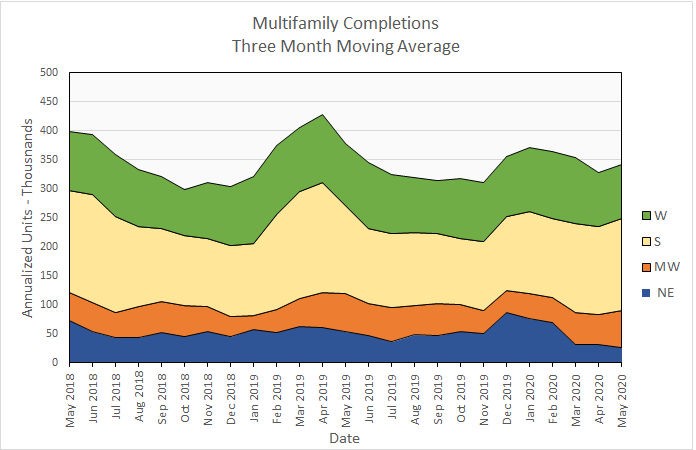

- Completions Remain Soft:

Construction Costs Expected to Ease for Apartment Developers

National Real Estate Investor

- Many of the pressures driving increases in materials and labor prices for multifamily construction have lessened as a result of COVID-19

- Developers aren’t exactly finding bargains at the moment, since there’s now also downward pressure on rents and potential returns

- The net result is that even as more companies re-open for business most multifamily developers are still hesitating to start big projects or sign big deals to purchase materials

- On balance, a minority of developers (17 percent) say that prices are rising for materials they need to build apartments

- Prices plunged at the onset of COVID-19 cases, but since then, prices have rebounded

- “The lumber market dropped for a couple of weeks right at the beginning of the pandemic but that was quickly offset by price increases,” says Padgett

- Despite those numbers, most experts expect materials costs to dip over the next year, as it gradually becomes clear how quickly many of the more than 45 million of jobs lost in recent months come back and how many renters will be able to pay market rents at new apartment developments

- Developers aren’t exactly finding bargains at the moment, since there’s now also downward pressure on rents and potential returns