NMHC Construction Survey (Round 2) shows continued pressure throughout the multifamily construction sector, while forward-looking metrics (permits, starts, completions) also continue to decline. One shining light: affordable housing looking attractive as a defensive investment play going forward.

Below are key takeaways from the following reports:

2020 Construction Survey (Round 2) – National Multifamily Housing Council – Link

Multifamily Housing Construction Down in April – YieldPro – Link

Why Affordable Housing Construction Will Shine Despite COVID-19 – Multi-Housing News – Link

Download the PDF version of this report here:

2020 NMHC Construction Survey (Round 2)

National Multifamily Housing Council

- NMHC collected 84 responses from leading multifamily construction firms for the NMHC COVID-19 Construction Survey, Round 2. This was the second installment in a series of surveys; the first round of this survey was conducted in late March and collected 135 responses

- From Round 1:

- Construction delays increased 2% to 56% of respondents;

- Permitting delays increased 1% to 77% of respondents;

- Start delays increased 11% to 70% of respondents;

- Construction moratorium delays decreased 22% to 62% of respondents;

- Labor-related delays increased 3% to 44% of respondents

- From Round 1:

Multifamily Housing Construction Down in April

YieldPro

- Census Bureau April 2020 report shows reduced activity in all stages of the multifamily construction pipeline

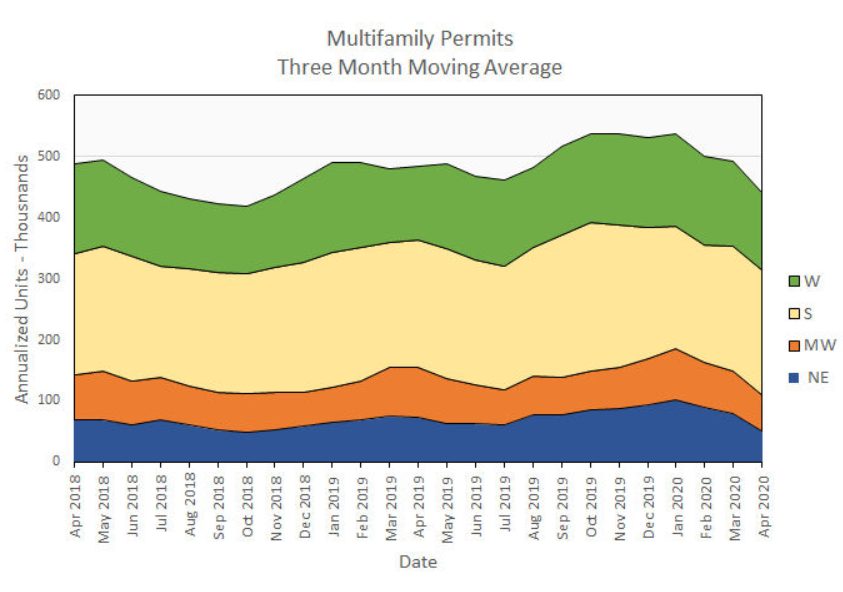

- New permits down 12% from March (23% Y/Y):

-

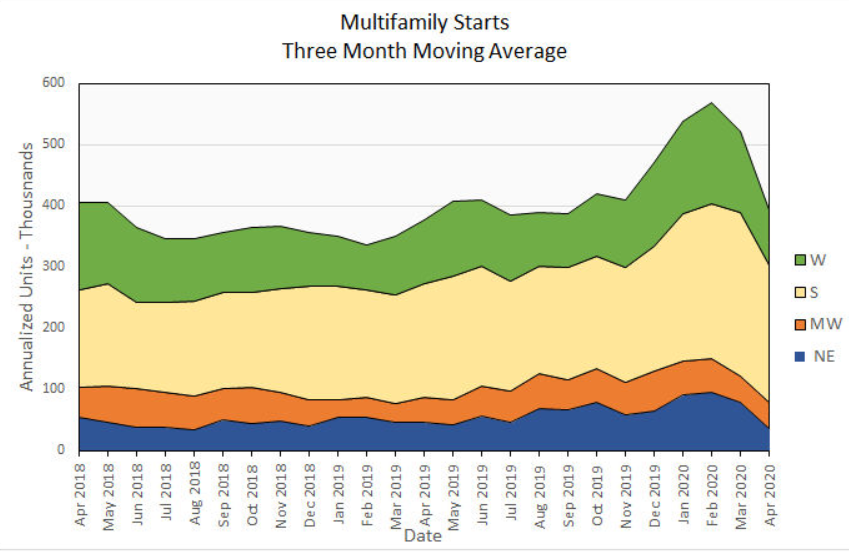

- Starts down 25% from March:

-

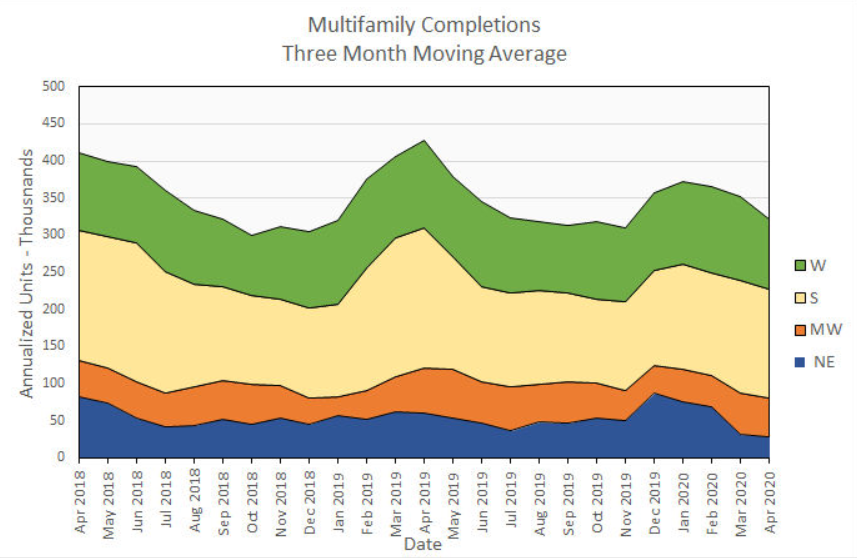

- Completions down 8% from March

Why Affordable Housing Construction Will Shine Despite COVID-19

Multi-Housing News

- Affordable housing demand has always outpaced supply – even now

- High unemployment figures could mean more people will be seeking affordable housing as the market struggles to recover

- Cities are placing an emphasis on affordable development

- Negative impacts of homelessness and lack of affordable impact during the pandemic driving officials to re-evaluate plans

- Affordable housing considered a more stable investment

- Section-8 vouchers result in lower defaults

- Affordable housing considered a defensive real-estate investment