The impact of COVID-19 on the multifamily market continues to shift trends to suburban and southeast construction starts. The overall market remains mixed for the September report, with permits roughly flat, and construction starts down, but completions ticking upwards. An unlikely contender, New York City, is set to buck the suburban trend with $55 billion of expected spending. While down 8.5% year-over-year, $55 billion is still in line with a record-breaking 2017.

Below are key takeaways from the following reports:

Uncertainty Shades a Once-Soaring Multifamily Construction Market – Building Construction + Design – Link

A Mixed Report For Multifamily Housing Construction – YieldPro – Link

NYC Construction Forecast Remain Strong – Globe St. – Link

Download the PDF version of this report here:

Uncertainty Shades a Once-Soaring Multifamily Construction Market

Building Construction + Design

- Demand varies by region, influenced by perceptions about the economy, COVID-19, and the election

- Southeast multifamily construction remains steady

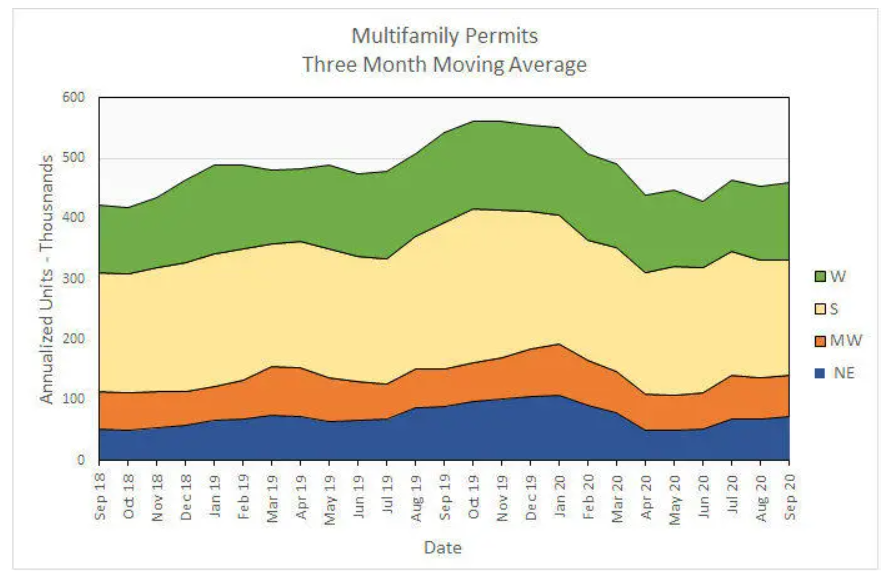

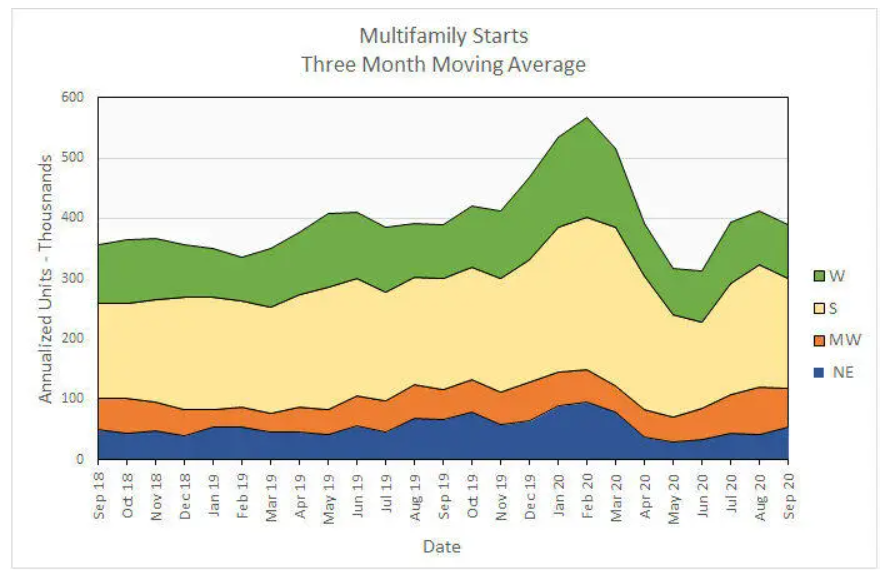

- On a national level, the annualized rate for housing starts in buildings with five more apartments stood at 295,000 units in September, 17.4% below starts for the same month in 2019. Multifamily permits, a barometer of future building, were also down in September, by 22.2% to 390,000 units.

- This national pullback notwithstanding, large multifamily projects continue to get built, often as centerpieces of ambitious redevelopment plans

- Both luxury and affordability in demand

- Multifamily continues to address a full range of price options, and higher-end products remain attractive

- However, it also appears that more of what’s being developed, designed and built targets tenants and buyers seeking affordability

A Mixed Report For Multifamily Housing Construction

YieldPro

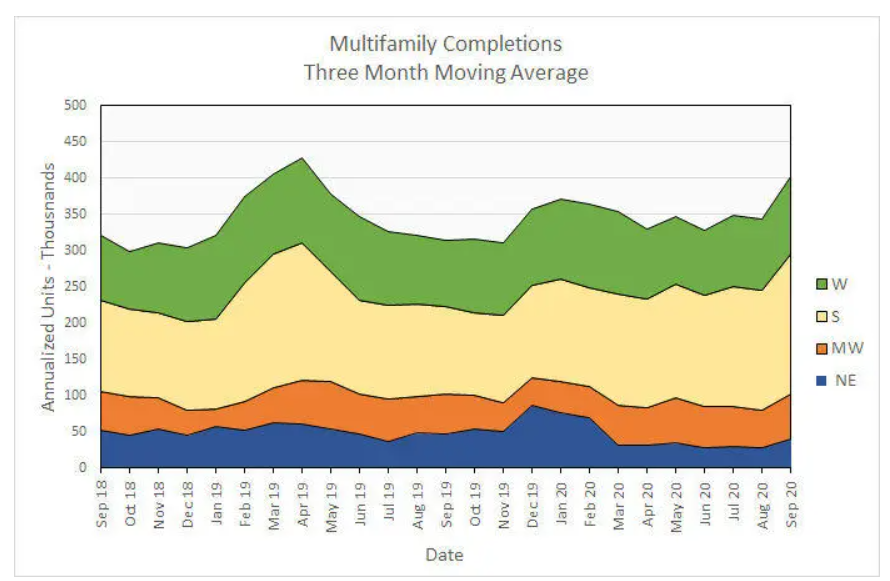

- The Census Bureau released its monthly new residential construction report for September 2020. It shows weakness for permits and starts but a surge in completions of multifamily housing units.

- Permits Rebound Mildly:

-

- Multifamily Housing Construction Starts Drop:

-

- A September Blowout for Multifamily Completions:

NYC Construction Forecast Remain Strong

Globe St.

- According to the New York Building Congress’ Construction Outlook 2020-2022 report, 2020 construction spending is forecasted to exceed actual spending from eight of the past 10 years, despite the impacts of COVID-19

- The report suggests that construction spending is expected to reach $55.5 billion in 2020

- An 8.5% decline from 2019’s $60.6 billion in construction spending

- The estimated $55.5 billion would match 2017’s then-record-breaking amount

- “While New York City was one of the hardest-hit areas in the US and is still reeling from the effects of COVID-19, the building industry is weathering the storm and remains the heartbeat of the city’s economy,” states Carlo A. Scissura, President & CEO of the New York Building Congress. “This report evidences both the resiliency of the building industry and that investment in infrastructure creates jobs and boosts economic recovery. The Building Congress will continue working to ensure that this growth lasts for years to come.”

- The report suggests that construction spending is expected to reach $55.5 billion in 2020